Mr. Shriram Ramanathan

Chief Investment Officer - FIXED INCOME, HSBC Mutual Fund

CIO - Fixed Income, overseeing the management of about INR40,000cr (~USD 8bn), in assets across various Fixed income and Hybrid funds (INR only).

He has been in the Asset Management business since 2001 and has over 22 years of experience in fixed income markets.

Prior to joining HSBC Asset Management, he was Head of Fixed Income at L&T Investment Management Limited (2012-2022).

From 2010-2012, he was Portfolio Manager at Fidelity (FIL) Fund Management managing their India domiciled INR FI funds.

From 2005-2009, Shriram was based in Hong Kong at ING Investment Management Asia Pacific, where he managed multi currency portfolios as Senior portfolio Manager, Global EMD (Asia) - co-managing the Asian portion of Emerging Market Debt funds, with focus on sovereign HC and LC rates/ FX, as well as pure Asia local currency funds / mandates.

His earlier assignments were with ING Investment Management India as Fixed Income Fund Manager, Zurich Asset Management Company in fixed income research and with the Treasury department of ICICI Ltd, where he started his career in investments in 2000.

Shriram is a Chartered Financial Analyst and holds a Post Graduate Diploma in Business Management from XLRI Jamshedpur and an Engineering degree from the University of Mumbai.

Q1. To maintain liquidity, the RBI has implemented several measures, including the highest net OMO purchase activity in India since FY21. Now that there is a surplus in the system, how do you see the RBI's focus evolving, and what could be its next steps to sustain economic growth?

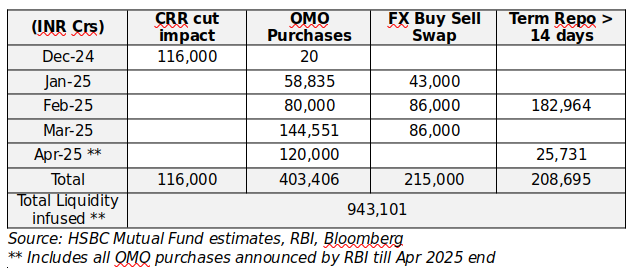

Ans 1. RBI has been extremely proactive in managing liquidity over the last few months, delivering more than market expectations. The below table highlights the liquidity tools utilized by RBI over the last few months. By the end of April 2025, RBI would have injected around INR 7.3 Lakh Crs worth of durable liquidity into the system (including CRR cut, OMO purchases and FX Buy Sell Swap).

In the recent Monetary Policy Committee (MPC) meeting, the Governor emphasized that the RBI is committed to provide sufficient system liquidity and will proactively take appropriate measures to ensure liquidity remains adequate. At the press conference, the Governor indicated that a surplus of around 1% of net demand and time liabilities (NDTL) was considered as a reasonable assessment of liquidity. RBI believes that maintaining this surplus is essential to ensure that the policy easing conducted till now and future rate cuts get transmitted effectively into the economy. We believe RBI will continue to support growth through further policy easing and liquidity infusion.

Q2. What are your expectations for the interest rate cycle, considering the growing indications of potential easing? Reports suggest that the RBI governor may lean toward lowering interest rates further. Are you anticipating a mild or more significant easing, and what assumptions are you factoring in for interest rates in India?

Ans 2. Domestic inflation has softened considerably, with the last two inflation prints significantly below 4%. The outlook for food inflation has turned decisively positive on robust agriculture output. RBI expects headline inflation to remain below 4% for the next three quarters and FY2026 inflation to be at 4%. Recent fall in crude prices also augers well from a domestic inflation perspective. On the other hand, RBI revised lower their GDP forecasts, with FY2026 GDP now expected at 6.50%. With global trade and tariff related policies clearly expected to impede growth, risks of growth numbers undershooting estimates remain. Against this backdrop, we believe RBI will continue to support growth through further policy easing and liquidity infusion.

Additionally, the stance change to ‘accommodative' in the recent MPC meeting clearly indicates a dovish shift in policy guidance, and implies that the current easing cycle could see deeper rate cuts than earlier envisaged. We expect RBI to further cut rates by another 50-75 bps taking the terminal rate to 5.25%-5.50%, assuming inflation remains in line with RBI estimates.

Q3. Indian bond yields have been hitting three-year lows, driven by the RBI's OMO purchases and global market dynamics. How do you see bond yields evolving from here, and what's your perspective on their future movement?

Ans 3. Indian bonds continue to see positive momentum. What started initially, with the global index inclusion (adding another significant investor segment to Indian bonds), continued with domestic demand supply turning favourable driven by fiscal discipline demonstrated by the Government, positive growth in AUMs of domestic investor segments and followed up by easing in policy rates, liquidity infusion and large OMO purchases conducted by the RBI. India has remained resilient even in an environment of increased volatility in global markets, given RBI's proactive and timely measures.

However, we believe that there are further legs to this rally. We expect RBI to further cut rates by another 50-75 bps taking the terminal rate to 5.25%-5.50%. We also expect RBI to remain proactive on liquidity measures. RBI is also expected to transfer dividend to the Government to the tune of around INR 2.5 Lakh Crs in May, which will be positive for Government bonds. Corporate bond spreads also remain fairly high, and with liquidity expected to remain positive, we expect to see spread compression in corporate bonds. We continue to expect yields to move decisively lower, along with steepening of the yield curve and encourage investors to have adequate duration in their portfolios to benefit from lower rates, subject to their risk return frameworks.

Q4. S&P has revised India's GDP forecast downward by 20 bps, from 6.7% to 6.5%. Do you believe this downgrade is primarily due to tariff-related uncertainties, or could internal factors like commodity inflation, monsoon conditions, or other headwinds also be contributing? What do you think is the rationale behind this downward revision in India's GDP outlook?

Ans 4. We believe the downward revision of India's GDP by S&P from 6.7% to 6.5% reflects a combination of both global and domestic challenges. While tariff-related uncertainties and global trade tensions largely contribute to the revision, domestic factors also cannot be ignored. Slow capex revival along with muted pick in exports have impacted growth.

However, manufacturing activity is showing signs of revival and the services sector remains resilient. Investment activity is picking up on the back of the Government's push on infrastructure spending. While monsoons are expected to remain normal this year, the impact of heat waves will have to be monitored. From a debt market point of view, the underlying factors support a cautious outlook on growth and are likely to push RBI to stay accommodative for longer.

Q5. Do you believe bonds currently present a better investment opportunity than equities, given the rising uncertainty and stretched valuations?

Ans 5. Equities, both globally and domestically have remained fairly volatile over the last few months. Risks of recessionary impact in the US along with increased risks of tariffs and global trade wars along with stretched valuations can continue to keep equity markets volatile.

On the other hand, under a proactive RBI along with strong domestic macro fundamentals, benign inflation and relatively stable currency, we believe Indian debt markets are appropriately placed to offer favourable risk reward to investors. For investors looking at safety and steady income, Indian bond markets offer good value along with asset diversification and predictability in returns at relatively lower risk. Not only can investors benefit from steady income they can also possibly generate alpha in a falling interest rate environment while staying invested for a medium-term investment horizon. Corporate bond spreads also remain high, which are likely to benefit from spread compression in an easy liquidity environment.

We continue to expect yields to move lower, along with steepening of the yield curve and encourage investors to have adequate duration in their portfolios to benefit from lower rates, subject to their risk return frameworks.

Q6. As a Debt Fund Manager, what difference do you see in the thought process of two governors in terms of Liquidity, Inflation, and Growth?

Ans 6. While both Governors operated in different global and domestic macro environments, we observed few differences in the approaches of the two RBI Governors on different factors like liquidity, inflation, growth and currency.

In the earlier regime, just shortly after the Governor took over, the world was hit by the pandemic, which required the RBI to strongly support growth and keep easy liquidity in the system for a longer period of time for smooth functioning of the economy. This was broadly in line with what other Central Banks did during that period. However, once inflation picked up RBI had to tighten monetary policy. Over the last two-three years growth picked up sharply, and hence the primary focus remained on controlling inflation resulting in tighter monetary policy and subsequently tighter liquidity conditions. This was also because we saw multiple instances of sharp increase in food inflation due to various factors, which made it imperative to operate with primary focus on inflation. Hence, in the earlier regime the approach was more cautious and focused on protecting the economy from high inflation risks, as was the need of the hour. The Governor also believed that markets should operate in a low volatility environment as it allows smooth functioning of financial markets, which resulted in a period where Rupee became one of the least volatile currencies as RBI continuously intervened to keep Rupee fairly stable.

In the current regime, the Governor is seen to be prompt and more proactive in his actions. During the period where Dollar strengthened considerably, RBI let Rupee depreciate in line with other currencies to keep it competitive, but once RBI felt that speculative positions were building up, they intervened strongly to discourage such moves. Once, inflation turned benign, RBI focused attention towards growth, as was again the need of the hour. Not only did RBI begin easing rates, it also infused considerable amounts of durable liquidity into the system to ensure that rate transmission happens smoothly and promptly in the economy. One key difference observed was in the communication of policy stance by the Governors. While earlier there was some ambiguity in market participants pertaining to reference of stance (whether it referred to rate trajectory or liquidity), the current Governor made it explicitly clear that the stance provides policy rate guidance, without any direct guidance on liquidity management.

While both the Governor's approach reflected their reading of global risks, domestic inflation trends and India's growth path, India has and continues to remain a bright spot in terms of a strong monetary policy framework by RBI and stable macro-economic factors. We have respected the approaches of both the Governors and learnt to adapt our strategies accordingly.

Note: Views provided above are based on information in the public domain and subject to change. Investors are requested to consult their mutual fund distributor for any investment decisions.

Source: Bloomberg & HSBC MF Research estimates as on April 20, 2025 or as latest available

Disclaimer: This document has been prepared by HSBC Asset Management (India) Private Limited (HSBC) for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds of HSBC Mutual Fund; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall HSBC Mutual Fund/HSBC Asset management (India) Private Limited and / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein. This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited. Neither this document nor the units of HSBC Mutual Fund have been registered under Securities law/Regulations in any foreign jurisdiction. The distribution of this document in certain jurisdictions may be unlawful or restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. If any person chooses to access this document from a jurisdiction other than India, then such person do so at his/her own risk and HSBC and its group companies will not be liable for any breach of local law or regulation that such person commits as a result of doing so.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empaneled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, click here / refer website.

The above information is for illustrative purposes only. The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any research report nor it should be considered as an investment research, investment recommendation or advice to any reader of this content to buy or sell any stocks / investments. The Fund/portfolio may or may not have any existing / future position in these sector(s)/stock(s)/issuer(s).

© Copyright. HSBC Asset Management (India) Private Limited 2025, ALL RIGHTS RESERVED.

HSBC Mutual Fund, 9-11th Floor, NESCO - IT Park Bldg. 3, Nesco Complex, Western Express Highway, Goregaon East, Mumbai 400063. Maharashtra.

GST - 27AABCH0007N1ZS | Website: www.assetmanagement.hsbc.co.in Mutual Fund investments are subject to market risks, read all scheme related documents carefully. CL 2657