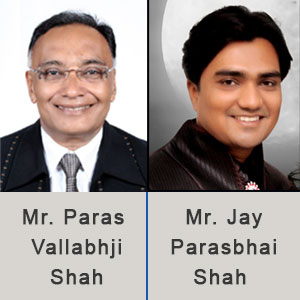

Mr. Paras Vallabhji Shah ( CHAIRMAN ) & Mr. Jay Parasbhai Shah ( MANAGING DIRECTOR )

Mandvi-Kutch – Gujarat

This time we are sharing an amazing and inspiring success story of patience, focus and client service from the obscure, small town of Mandvi in Kutch, Gujarat. Mr. Paras Shah, a veteran in the industry, along with his son – Jay Shah, are together well on their way to realise not only their dreams but also the dreams of their clients. We, at E-Saathi wish all the best to the Shahs and thank them for showing us that no-place is too small if your dreams are big!

ES: Please tell us something about yourself and your business?

Paras: I started my financial planning firm in 1980. My son Jay Shah, has also joined me in my practice. We have our presence in a small city of Mandvi, Kutch which has a population of just about 45,000 people. We are proud today to have a SIP book size of over Rs.56 Lacs. We have a MF AUM of over Rs.32 crores and also advise over Rs.250 crores of non-mutual fund assets.

We believe that our success has been primarily due to the support of our clients and the trust they have in us. Thanks to them, we are among the top financial planning firms here.

ES: Please tell us about your vision and mission and philosophy to business?

Paras:

-

Our Vision: Our vision is to be the leader in our field of business through:

-

Total Customer Satisfaction

-

Commitment to Excellence

-

Determination to Succeed with strict adherence to compliance

-

Successful wealth creation of our customers

-

-

Our Mission: Independent ideas. Topnotch advice. Independent wealth.

-

Our Philosophy: We aim to provide need-based solutions for long-term wealth creation. Our primary measure of success is customer satisfaction.

ES: What inspired you to choose the career of a financial advisor and then as a Partner of NJ?

Answer :

Paras: We have seen many ups and downs in the lives of people around us, and we strongly felt that everyone should plan for a better tomorrow. This motivated us to be financial advisors. This profession helps us to live and work for our dream to make a wealthy society. In this journey, we became NJ Partners in 2003. I remember Mr. Prashant Kakkad coming to our office at Mandvi, Kutch and helping us understand the need to join NJ.

Jay: My father took the decision of joining NJ without wasting a minute. As my father is a very far sighted man, he knew the value of the services, philosophy and platform provided by NJ.

ES: Client communications is an integral part of your business. Please share some practices followed by you?

Answer: There are a few things, we would like to mention which we practice religiously:

-

Schedule regular client meets

-

Also schedule one-on-one calls

-

Answer all client questions without creating hype

-

Hold regular conference calls

-

Use social media with caution

-

Send relevant reports every month

ES: How do you approach your advisory practice?

Answer: We find exactly what the investor wants. We also consider the client's risk profile and asset allocation while giving our advise. We aim to create plans which are perfect road maps for investors of their wealth creation journey. This is done in a very unbiased manner. Any advice investor receives from us is fully impartial and focused on his interests alone. We only suggest products if they meet our criteria. Our idea is to deliver real value to our clients.

The value that comes from our financial advice may focus on numerous aspects viz.

-

Return on investment: Getting back more money than invested, including the cost of the advice

-

Future security: Ensuring you have enough income in your later life (e.g. pension planning)

-

Peace of mind: Ensuring that youhave made the best practical choices and obtained the best deals that the market has to offer

-

Protection: Making sure that you and your family have safeguards in place against unfortunate events (e.g. illness, job loss, premature death)

-

Achieving goals: Overcoming challenges and reaching milestones (e.g. finding the right mortgage for clients' dreams.

-

Avoiding mistakes: Reducing the risk of making financial decisions you regret, or falling victim to fraud

-

Opportunities: Discovering new and unexpected ways to make your money work harder for you

ES: You mentioned your client's trust as one of the reasons behind your success. Why do you believe the client's trust you?

Answer: There are 3 key things we wish to highlight:

1. Client Privacy: Client privacy is very important for us. For investor peace of mind, we don’t share their details with anyone else.

2. Unbiased advice: Our advice is trusted, honest and focused on what is best for the client, not influenced by product sales.

3. Personalised advice: We take time to understand each client’s unique challenges and goals and provide tailored solutions for each client.

ES: What is your experience on the technology related initiatives made by NJ from time to time?

Answer: Simply Superb. In the present day cut-throat competition, team NJ and NJ Technologies are the Heart and the Brain of any financial consultant. With the core support that we have received, we have grown our business considerably. Mr Neeraj Choksi, Mr Jignesh Desai and team NJ, are providing fabulous solutions to people like us and it helps boost a NJ Partner to achieve great success.

What advantages do you feel E-Wealth offers to both Clients and Partners?

Answer: The freedom of doing business by breaking the barriers like place and time is the biggest gain. E-Wealth is the best platform we have ever seen – very easy to transact for Clients as well as Partners, making our life much easier. We can now provide our services very effectively and promptly. Managing money is now at the fingertips of the client.

ES: How do you see the future of our industry? How can you as Partners be ready to make the most of it?

Answer: The financial advisory business will grow by leaps and bounds. We will need to adapt to the “best” and the “next” practices of the industry. As a Partner, we strongly believe that we must convert our physical business to NJ online platform. This way, we will find the much needed time for client acquisition and other value-adding services. We would also suggest Partners to effectively and adequately use NJ's marketing strategies, NJ BizMall and NJ Gurukul services.

Beyond this, we would say that setting up the advisory practice takes time. We too have faced many challenges. Always sustain the investor and keep their temperament for staying invested; keep faith in your advise and the road map for their future. Have faith in the business.

ES: Can you please share your short term and long term targets for your business?

Answer:We focus a lot on building our SIP book and 75% of our mutual fund AUM is built through SIP route. So firstly, we would like to have a SIP book size of Rs. 1 crore by 2018. Secondly, we are targeting mutual fund AUM of Rs.100 crore by 2020.

ES: Anything you wish to add...

Answer: We want to extend our Special Thanks to …

Mr. Neerajbhai Choksi & Mr. Jigneshbhai Desai,

Mr. Prashantbhai Kakkad & Mr. Manishbhai Ambani

Mr. Manishbhai Gadhvi & Mr. Abhaybahi Khunti

And Team NJ for their wonderful platform, support, relationship, values and ethics.

“NJ MAKES LIFE BEAUTIFUL”

{s}

[[script type="text/javascript"]]

$(document).ready(function(){

new DiscussionBoard("divDiscussionBoard", "401", "http://www.njwebnest.in/esaathi/index.php/discussion").load();

});

[[/script]]

{/s}