Mr. Viral Shah

Principal Officer, NJ Advisory Services Pvt Ltd.

Mr. Viral Shah has been preparing various strategies for PMS investment. Prior to joining, NJ Advisory Service Pvt Ltd., he worked as Research head at NJ India Invest Pvt. Ltd. and looked after mutual fund research, portfolio review and managing portfolio of NJ group companies and select corporate clients.

ES: Please tell us about what offerings does NJ PMS offer to investors?

Viral: We have seven strategies open for subscription for the clients. We have three Dynamic Asset Allocation strategies, namely

-

Dynamic Stock Allocation Portfolio (DSAP),

-

Dynamic ETF Allocation Portfolio (DEAP) and

-

Dynamic Asset Allocation Portfolio Direct (DAAPD).

In addition, we have four Equity strategies, namely

-

Multicap Portfolio,

-

Freedom ETF Portfolio,

-

Bluechip Portfolio and

-

Freedom Direct Portfolio.

ES: Can you please briefly introduce us with your flagship portfolios. Please also tell us to whom should the portfolios be suitable for investment?

Viral: For us, all strategies are equally important. Client has to choose based on his/her risk appetite and investment objective.

Dynamic Asset Allocation Portfolios endeavor to generate better 'Risk Adjusted' returns by changing asset allocation among debt and equity asset class. Clients with reasonably medium to longer-term view and medium to higher risk appetite can choose dynamic asset allocation portfolios.

Equity Portfolios endeavor to generate better absolute returns in long term. Clients with reasonably longer-term view and higher risk appetite can choose equity portfolios.

ES: In dynamic asset Allocation portfolios, how asset allocation is decided? How re-balancing is done in Dynamic Asset allocation portfolios?

Viral: In all dynamic asset application portfolios, asset allocation is decided based on the back tested asset allocation. Back testing has been done for more than 20 years covering bullish, bearish and flat market conditions.

For existing clients, re-balancing is done on half yearly basis. For fresh purchases and top ups, asset allocation is changed every month so that at the time of re-balancing, lower churning needs to be done for the clients.

ES: In DSAP, please also explain how stock selection is made and the allocation between large-cap and mid-cap within the equity allocation.

Viral: IN DSAP, equity portfolio will be same as Multicap Portfolio.Allocation to each security is based on the asset allocation decided for the strategy.

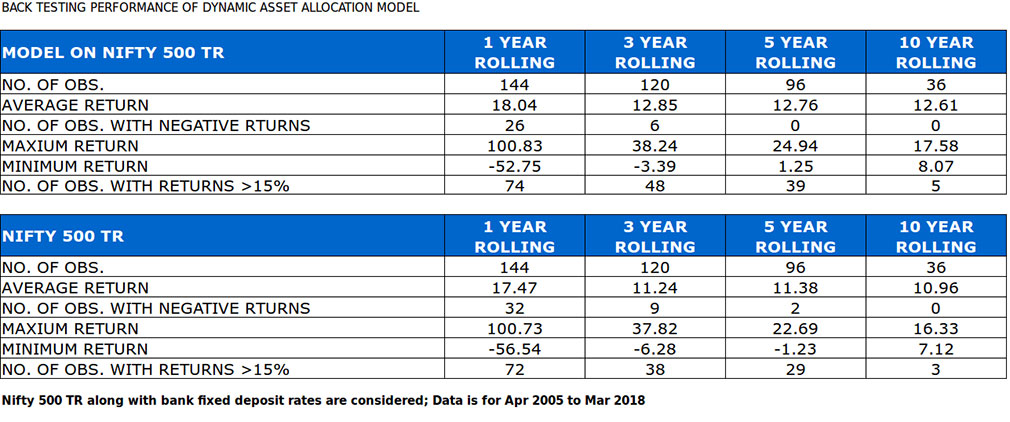

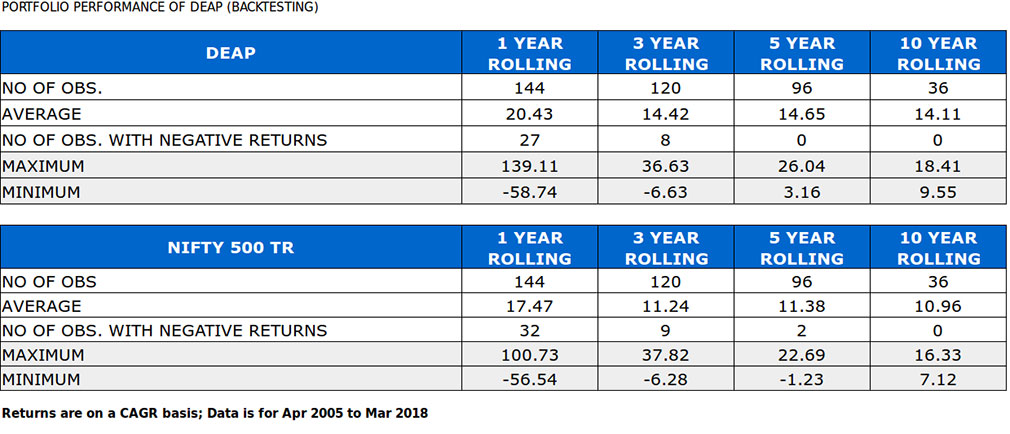

ES: Can you briefly share the past performance of your dynamic portfolios and your view on future expected returns /performance from them?

Viral: Please find below performance

DAAP

DEAP

We believe discipline followed based on asset allocation and selection of securities will drive the returns. We are confident that the dynamic asset allocation portfolios will continue to generate better risk-adjusted returns.

ES: In the pure equity space, you have three flagship portfolios, Freedom ETF, Multi cap and Blue chip portfolios. How do you compare the risk-return profile between these portfolios?

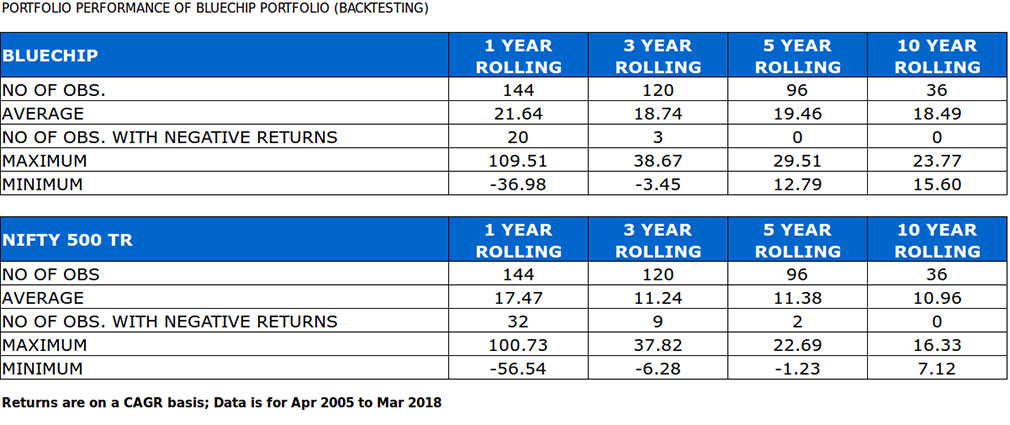

Viral: All strategies being equity strategies, have higher risk. As per back testing results, Blue chip Portfolio has lower volatility compared to other equity strategies.

ES: Can you explain the stock selection process for Multi cap and Blue chip portfolios?

Viral:

Multicap Portfolio:

IISL Alpha 50 Index is used for the universe of the portfolio. Top 25 stocks are selected based on Alpha of securities.

Bluechip Portfolio:

Securities are selected based on following parameters from top 300 companies (based on total market capitalization):

Return on Capital Employed (RoCE),

Return on Equity (RoE),

Revenue Growth,

Loan Growth,

Free Cashflow, etc.

ES: It seems that you have adopted a purely quantitative approach towards stock selection. Can you please explain why it is so and the advantages of such an approach?

Viral: Yes, we follow rule based investing. So we completely rely on financial data, prices and other publicly available information on securities for selection of securities.

Worldwide, passive funds are beating most of active funds. In India too similar trend is emerging. Going forward, it will be more difficult for active funds to outperform passive funds like ETFs. Further, in rule based investing, there are no biases related to securities.

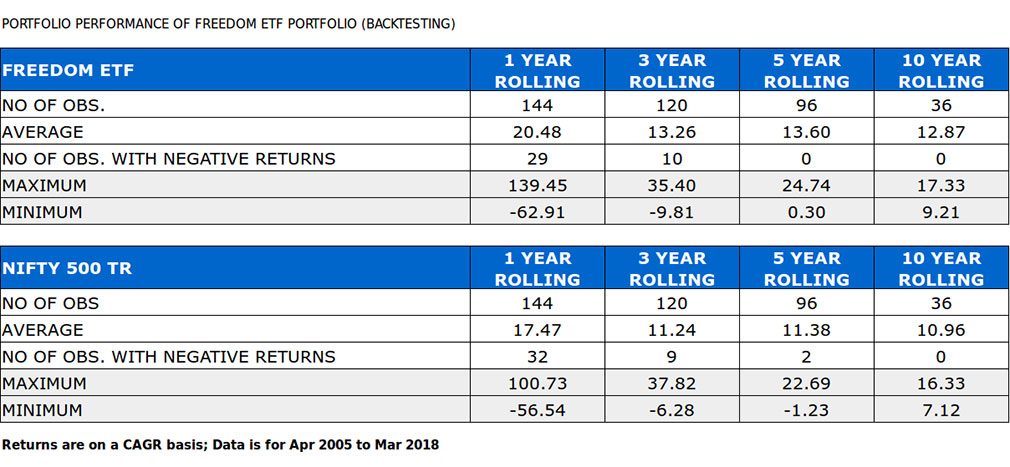

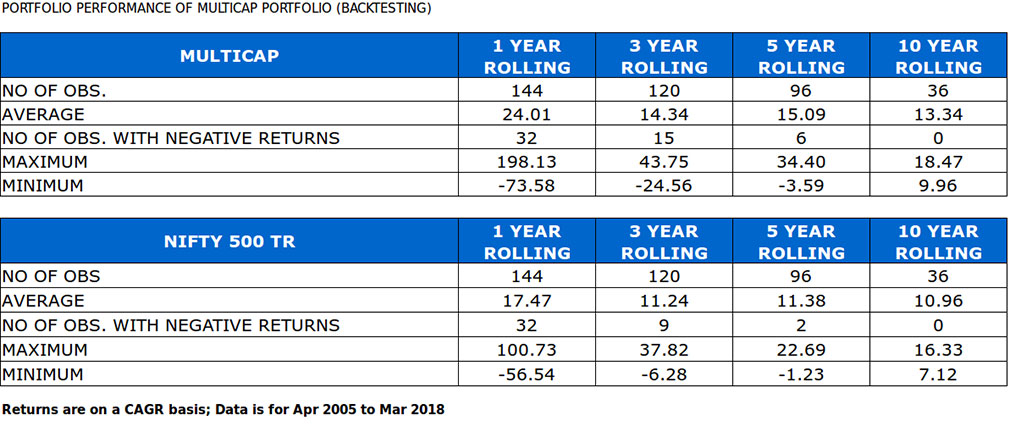

ES: Can you briefly share the past performance of your pure equity portfolios and your view on future expected returns /performance from them?

Viral:

Please find below performance

Freedom ETF Portfolio

Multi Cap Portfolio

Blue chip Portfolio

We believe discipline followed based on selected parameters, no biases related to securities should help equity strategies to perform well in longer periods.

ES: Should new investors be investing in dynamic asset allocation or pure equity portfolios at this point of time? How can the investor or the Partner assess which is the right portfolio for the investor?

Viral: Partner should clearly understand the risk appetite, time horizon and expected rate of returns from the client. After discussing with client, partner should decide proper strategy for the client.

ES: Please give details of time line of re-balancing for NJ PMS strategies

Viral:

-

Name of the strategy

Re-balancing periods

DSAP

April (security and asset allocation and September (asset allocation)

DEAP

March (security and asset allocation and September (asset allocation)

Freedom ETF

March (security re-balancing)

Multi cap

April (security re-balancing)

Blue chip

June / July (security re-balancing)

Please note above re-balancing period for strategies are tentative basis only. NJ PMS team may change re-balancing period time to time for benefit of clients.

ES: Let us know about portfolio comparison tool being developed by the NJ Advisory.

Viral: Yes, We have already developed it and also made available on partner desk for few days in the past when it was in beta testing phase. But now we are ready for its launch and by the time this interview gets published, it will be launched. This tool definitely would aid our partners to compare direct equity portfolios of their prospective PMS clients by simply importing the portfolio and also fetching the client desk portfolio for their existing clients. More about the tool will be communicated shortly by the team.