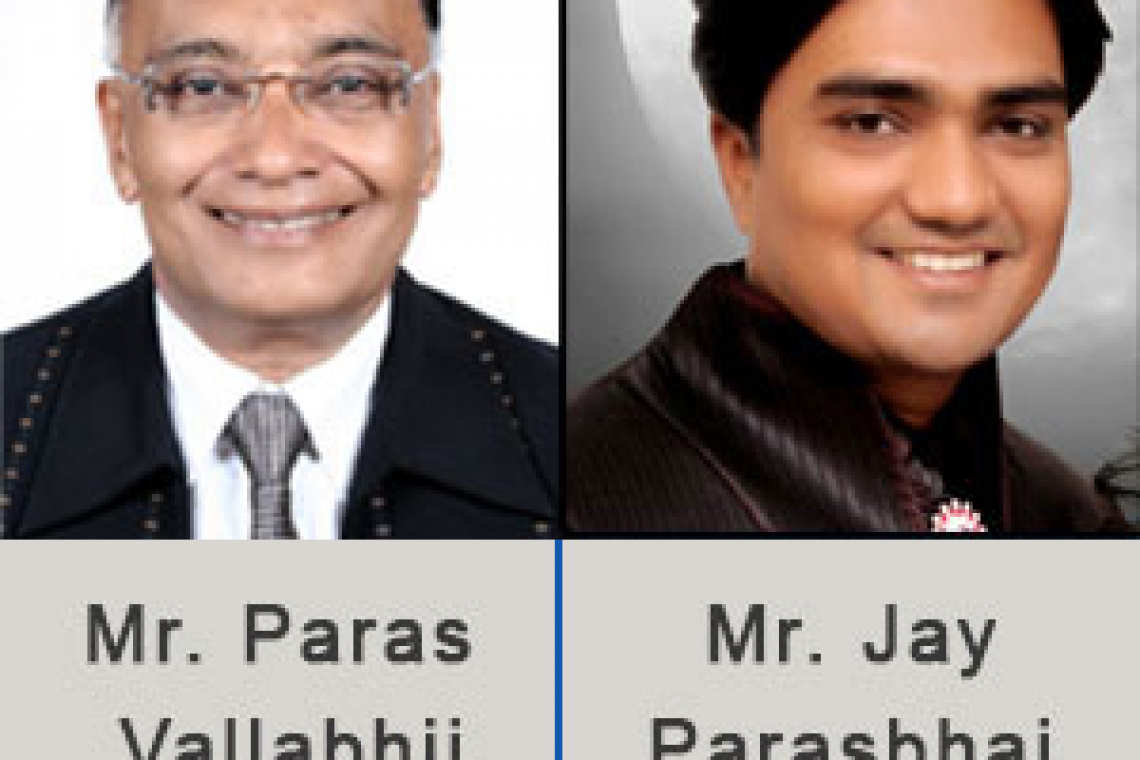

Mr. Paras Vallabhji Shah ( CHAIRMAN ) & Mr. Jay Parasbhai Shah ( MANAGING DIRECTOR ) - Mandvi-Kutch, Gujarat

Q : Please introduce yourself and also share your vision and mission or goals in life?

Answer : We, My father Paras Vallabhji Shah and my mother Chandrika Paras Shah started our financial planning firm in 1980.With her whole hearted support and great devotion we have built this advisory empire, In 1999 I Jay Shah joined the firm. In 2010 my wife Hetal Shah has also joined us in our practice. We started our business in a small city of Mandvi, Kutch which has a population of just about 45,000 people. We serve across the globe due to NJ Technologies, We have a SIP book size of over Rs.80 Lakhs. We have a MF AUM of over Rs.130 crores and also advise over Rs.280 crores of non-mutual fund assets. Due to team work and family support, “Paras Vallabhji Shah And Associates” could grow.

Our vision is to be the leader in our field with:

1. Total Customer Satisfaction

2. Commitment to Excellence

3. Determination to Succeed with strict adherence to compliance

4. Successful wealth creation of our customers

Our Mission: Independent ideas, Top notch advice and Independent wealth.

Our Philosophy: We aim to provide need-based solutions for long-term wealth creation. Our primary measure of success is customer satisfaction. We have seen many ups and downs in the lives of people around us, and we strongly felt that everyone should plan for a better tomorrow. This motivated us to be financial advisors. This profession helps us to live and work for our dream to make a wealthy society.

Q : What inspired you to choose the career of a financial advisor / distributor?

Answer : We have seen many ups and downs in the lives of people around us, and we strongly felt that everyone should plan for a better tomorrow. This motivated us to be financial advisors. This profession helps us to live and work for our dream to make a wealthy society.

Q : Do you promote the idea of savings through MF SIP in your clients?

Answer : Yes, SIP is a game changer for both distributors and investors. We would like to advise all the partners that we strongly suggest you to work on NJ's Formula of 1%,1.5% & 2% of SIP books of your AUM

Q : Client communications is an integral part of your business. Please share any best practices / services related to communications adopted by you.

Answer : There are a few things we would like to mention which we practice religiously:

1. Schedule regular client meets

2. Also schedule one-on-one calls

3. Answer all client questions without creating hype

4. Hold regular conference calls

5. Use social media with caution

6. Send relevant reports every month

Q : How much importance do you give to Insurance in your advisory practice?

Answer : Insurance is a vital component during every investors life cycle from wealth creation - wealth preservation - wealth transfer, the basic and First step is WEALTH PROTECTION. we always insist our clients to start journey with first step of protection.

Q : How do you educate and convince your clients for mutual funds, especially the first time investors?

Answer : I like to answer this questions in two part- 1. Education and 2. Convincing for investments

1. Educating clients is on going process we can't educate them in one or two meetings. As per learning is life long process so we are doing webinars, inviting them to Saturday schools preparing concept based videos etc. Doing many things for educating clients, because once your clients get knowledge of all concepts, our life became very easy.

2. For convincing -we are following planning as tool. Everything is achievable if follow the plan. So we try to gather as much data as possible, we evaluate the needs of an investor by using NJ FAMILY NEED PLANNING UTILITY, it helps investor to prioritize the goals as per the feasibility of the cash in flow with the prospective investor, in second step we offers our product basket as per their need .

Q : Your experience with NJ's technology initiatives in terms of various Desks for Clients & Partners?

Answer : NJ Technologies is shaping the future of financial services industry. With increased digitalization, financial services industry has become more efficient, highly productive and is capable to accelerate the economy to the next level. Disruptive technologies are responsible for drastic change in various industries. It has changed the face of the world, each time a new innovative technology is introduced by NJ India, it may lead to phenomenal change in the way existing industry

operates.

Q . What advantages do you feel NJ E-Wealth offers to both Clients and Partners?

Answer : N- numbers of advantage of NJ E Wealth, it empowers partners to manage the existing business and scale new heights, and give convenience and flexibility to clients for managing their wealth on fingertips. if you want to manage clients portfolio very actively you must have E-wealth of all your clients.

Self evaluation and assessment is something we all should do regularly. How do you assess your self and/or your business? Is there any specific parameters you refer to?

True assessment is somethings which helps us to do mind storming for ourselves. We do Business planning every year without fail and at that time we check last year planning also to check where we made mistakes. Based on that we come to know and we will avoid such things in future. We are doing financial year business planning since 2015-16, earlier there was excel sheet for planning. We try to get investors feedback, your unhappy clients are the real source of learning. We try to resolve wherever we are lacking.

Q : How much importance do you give to Asset Allocation & Risk Profile while offering solutions to clients' needs ?

Answer : 100 %. its an initial and very important step in wealth creation. MARS helps a lot for better asset allocation and timely rebalancing of investments. NJ india provides advanced solutions. MARS was introduced in 2013, at that time very few convinced for this but now everyone following rule of asset allocations and re-balance.

Q : Winning the trust of a Client is not an easy task. How do you think you can win the trust of Clients?

Answer : 1. Client Privacy: Client privacy is very important for us. For investor peace of mind, we don’t share their details with anyone else and with EWA, things are more secured as holding is in Demat form.

2. Unbiased advice: Our advice is trusted, honest and focused on what is best for the client, not influenced by product sales.

3. Personalised advice: We take time to understand each client’s unique challenges and goals and provide tailored solutions for each client for their respective Goals and challenges they have for their future.

Q . What suggestion / advice you would like to give to new Partners who have not yet established themselves into the business?

Answer : 1) Maximum utilization of NJ resources, NJ e wealth, NJ Digitalks.

2) Have conviction in the mutual fund business and trust in yourself

Q . Can you please share your short term and long term targets for your business

Answer : we are aiming to achieve 500 crores of mutual fund AUM and the sip book of 4 crores by year 2026.

Q. Have you acquainted yourself with the current lock-down situation due to pandemic COVID-19? What are your experience for business continuity its growth? Did you find it difficult?

Answer : Yes, it was quite difficult, despite of pandemic situation we could do business thanks to NJ TECHNOLOGIES

Q . Share your thoughts on NJ Digital Talks? Whether you and your clients are benefited from it or not. Also, NJ Management has announced other initiative to help partners and clients, share your thoughts on it.

Answer : NJ INDIA HAS DONE PHENOMENAL WORK, due to digi talks we and our clients could learn and prosper, NJ INDIA has always come out with innovative initiative to help partners and clients